Members

Investment decisions

When it comes to choosing how to invest your pension funds, there is no right answer.

Much depends on your age, your other assets, your planned retirement date and your comfort with risk.

We encourage you to review your personal circumstances with one of our Retirement and Pension Advisors or a qualified financial advisor at your financial institution to make a decision that's right for you.

Investment choices

You can choose how to invest your pension funds in the CSS Pension Plan, though you're not required to.

What are my choices?

The CSS Pension Plan offers four investment funds – a Money Market Fund, Bond Fund, Balanced Fund and Equity Fund. Each fund – or combination of funds – has different levels of risk and expected returns. How you choose to invest your pension funds can impact your retirement plan.

Do I have to choose?

No. Members who do not want to set and monitor their own asset mix are automatically invested into the Balanced Fund. The Balanced Fund is the Plan's original diversified investment option.

Can I change my mind?

Yes. We understand that life circumstances and retirement plans can change, so you are free to move as little or as much of your pension funds as you like to any of the four funds, at any time. See changing your investments for instructions on how to do so.

What should I consider?

To make an informed choice, you should consider the following questions:

1. When will I retire?

2. How much pension funds will I need?

3. What type of retirement income do I want?

Your answers to these questions will affect how your pension funds should be invested. For help answering these questions, you should consult one of our Retirement and Pension Advisors or a qualified financial advisor at your credit union or bank.

Investment risk and return

Market timing risk

"Market timing" is the strategy of moving pension funds among the Plan's investment options in response to short-term market conditions.

Although you are free to do so, here are some things to think about before you take action.

Investing in retirement

During most of your working life, your investment strategy should be focused on growing your pension funds. Investing in a broadly diversified portfolio of high-quality investments may produce moderate growth over the long term with managed short-term volatility.

If this is your objective, you may wish to stay invested in the Plan’s default investment option – the Balanced Fund. It is professionally managed, automatically rebalanced and invests approximately 55% in equities and 35% in fixed income and 10% real estate investments.

If you’re willing to take on more risk of short-term losses to have the opportunity to earn higher average returns, you may wish to allocate more of your pension funds to the Plan’s highest risk/return option – the Equity Fund. You could do this by re-allocating part of your pension funds from the Balanced Fund to the Equity Fund, or by re-allocating all your pension funds to the Equity Fund and Bond Fund in the proportions you desire.

Members are strongly encouraged to get advice before taking action. Feel free to contact one of our Retirement and Pension Advisors or try our risk tolerance estimator to assess your level of comfort with risk.

If you want to reduce your risk of short-term losses and be willing to earn lower average returns, you may wish to allocate more of your pension funds to the Plan’s lower risk/ return option – the Bond Fund. You could do this by re-allocating part of your pension funds from the Balanced Fund to the Bond Fund, or by re-allocating all your pension funds to the Bond Fund and Equity Fund in the proportions you desire.

You might also want to consider increasing the proportion of your pension funds invested in bonds as you approach retirement if you intend to get a traditional monthly pension from the Plan. This strategy could be useful since bond values tend to increase when long-term interest rates fall and make monthly pensions more expensive. Members are strongly encouraged to get advice before taking action. Feel free to contact one of our Retirement and Pension Advisors or try our risk tolerance estimator to assess your level of comfort with risk.

As you approach retirement your investment time horizon shortens. Growth tends to become less important while preserving your pension funds becomes more important. If you plan to retire soon and have already saved enough, then depending on the type of retirement income you want, you might want to increase the weighting that you have invested in the Bond Fund while allocating a portion of your account to the Plan’s most conservative option – the Money Market Fund.

The Money Market Fund can be used as a spending reserve for members intending to take a Variable Benefit payment from the CSS Pension Plan when they retire. The Money Market Fund can also be used to “exit the markets” for members nearing retirement and planning to take a traditional monthly pension, or those members intending to leave the Plan and invest in GICs or term deposits after retirement. Members are strongly encouraged to get advice before taking action. Feel free to contact one of our Retirement and Pension Advisors or try our risk tolerance estimator to assess your level of comfort with risk.

Investment risk is the possibility that you could earn less than you expect from an investment, or even lose some or all of your original investment.

There are many different sources of investment risk including:

-

Market risk – The risk that the value of an investment will decline due to a general decline in the markets.

-

Industry risk – The risk that the value of an investment will decline due to changes in the environment of a particular industry.

-

Business risk – The risk that the value of a company’s shares will decline due to poor management or adverse changes in the company’s business environment.

-

Default risk – The risk that a security issuer will not pay the interest promised or repay your principal when due.

-

Interest rate risk – The risk that an interest paying investment will decline in value due to an increase in interest rates.

-

Currency risk – The risk that a foreign investment will decline in value due to changes in currency exchange rates.

-

Inflation risk – The risk that the value of an investment will not keep pace with inflation.

The relationship between risk and return is a direct one – the greater the potential return, the greater the risk.

In the investment world, as in life, there is no “free lunch.” There are no low-risk investments that pay high returns.

For an investment, low risk means a low return. “Safe” investments like Canada Savings Bonds and T-bills are considered “risk free.” Unfortunately, however, “risk free” investments earn the lowest expected returns.

To the extent that an investment requires you to take on more risk, it must offer you a higher potential return. Like any rational risk-taker, you require a higher potential payoff when the odds of winning decline.

The CSS Pension Plan offers four investment funds – a Money Market Fund, Bond Fund, Balanced Fund and Equity Fund. Each contains different kinds of investments with different risk-levels and different expected returns.

When you join the CSS Pension Plan, your contributions are automatically invested in the Balanced Fund (our default fund) unless you instruct us otherwise.

The Balanced Fund is structured to produce reasonable growth over the long term. However, to produce this growth, the fund must take on a moderate level of investment risk.

Risk can be reduced, but not eliminated. True to its name, the Balanced Fund strikes a good balance between risk and return, using:

-

Asset class diversification

-

Investment manager diversification

-

Quality limits for fixed-income investments

-

Concentration limits for individual holdings

-

Rebalancing limits to maintain the fund's target asset mix

In combination, these strategies reduce the risk of suffering a catastrophic loss - but they do not eliminate all risk of loss. If the Balanced Fund were limited to “risk free” investments, your retirement savings would grow much more slowly.

It is difficult to watch the value of an investment fall, even for a short time.

Members want their pension funds to be invested safely. Yet market history indicates that the returns earned on “safe” investments are usually too low to produce an adequate retirement income.

By accepting a moderate level of investment risk, the long-term growth potential of an investment portfolio can be increased.

Growth of $100/month over 35 years

|

Investment |

Average return* |

Savings at retirement |

|

A |

2% |

$60,643 |

|

B |

4% |

$90,297 |

|

C |

6% |

$138,067 |

|

D |

8% |

$215,740 |

*The average returns shown above are used for comparative illustration only. Your actual returns will vary with the markets.

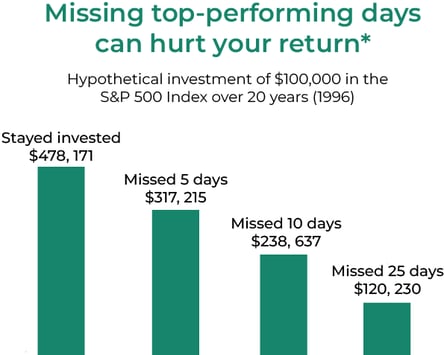

The classic "market timer" attempts to move a portfolio in and out of the markets in response to short-term market conditions. The objective is to be fully invested when markets are rising, and safely out of the markets just before the market begins to decline. There is only one problem – it can't be done consistently.

No matter how long or how hard you study investment markets, it is impossible to forecast the peaks and valleys of market performance accurately. Every investor would like to be in the market during rallies and out of the market just before each correction or crash. The problem is that markets can move suddenly, and by large amounts, in response to unforeseen events.

No one can tell in advance when the markets will rally or decline. Even professional investment managers can only make educated guesses. They often get it wrong.

If you try to move into low risk/low return investments when markets decline, and then move back into higher risk/higher return investments when markets rally, you could actually underperform compared with an investor who stays fully invested and rides out the ups and downs in a well-diversified portfolio of high quality stocks and bonds.

There are several reasons for this:

- You could sell out after the market decline begins, and perhaps even after the market decline is almost over. In this case you will be selling low, not high. This locks in your loss.

- Your costs will be higher than those of long-term investors. You will incur transaction costs and pay commissions every time you sell out or buy back into the markets.

- You could miss the initial stages of the next market rally – while you wait to be sure that a recent uptrend is real and will be sustained.

Mistiming the market's highs and lows could seriously impact your investment returns.

It is time in the markets - not timing the markets - that gives you the best chance of investment success.

Some retirees are uncomfortable with the uncertain returns earned on market-based investments, such as stocks, bonds, and mutual funds. They don’t want their retirement income to depend on market cycles. They want a steady retirement income.

If you want a steady retirement income, you will probably “exit the markets” when you retire. When you exit the markets, there is a risk that the effects of a short-term market loss could become permanent. If the fund(s) in which you are invested are in a loss position when you retire, this loss will become “locked in” when you move your pension funds into “guaranteed” investments. Once your pension funds exit the markets, their value will not recover when markets improve.

You can reduce this risk by gradually moving your pension funds into lower risk options during your final working years. For example, if you are five years from retirement, you could gradually move your pension funds from the Equity or Balanced Fund to the Bond and/or Money Market Fund in instalments. This would gradually reduce your exposure to short-term market losses.

Some retirees are more comfortable with the uncertain returns earned by market-based investments. They are willing to continue to accept investment risk, even after they retire, to have the opportunity to enjoy a higher retirement income. They are not distressed by the thought of receiving a variable retirement income.

If you are comfortable with a variable retirement income, you will probably continue to hold market-based investments, like stocks, bonds and mutual funds after you retire. The value of these investments will continue to move up and down with the markets. A short-term loss at retirement will therefore not become permanent. Moving all your pension funds to lower risk funds in stages as retirement nears, therefore, may not serve any useful purpose.

However, you could still move some of your pension funds into the Bond Fund to reduce the risk of short-term losses, or into the Money Market Fund to create a spending reserve. Then if markets were down when you retired, although some of your pension funds would track down with the markets, you would have other funds to spend while you wait for markets to recover. For example, moving one to three years of retirement income into the Money Market Fund as your retirement approaches could protect you from having to sell investments at a loss to pay your living expenses. If you already have cash reserves outside the Plan, then you may not need to take this precautionary measure.

VB payments are different from monthly pension payments. A traditional monthly pension is a fixed, guaranteed payment for life. VB payments, as the name suggests, can change from year to year and may not continue for life. A summary of the differences appears below:

|

Monthly pension |

VB payments |

|---|---|

| Monthly lifetime income | Monthly or annual withdrawals from investments |

| Cannot change the payment amount | Can change payment amount (within limits) |

| Pension funds are transferred to CSS Pension Plan and invested in long-term bonds | Pension funds stay invested in the Money Market Fund, Bond Fund, Balanced Fund and/or Equity Fund as instructed by the member |

| Payments continue for life | Payments stop when pension funds are all spent |

| Pension funds are “spent” to buy a fixed monthly payment | Any unspent funds belong to the member and can be left to a spouse or beneficiaries |

| Annual retirement income is fixed for life based on the long-term interest rate at retirement | Annual retirement income may vary with the returns on the member’s pension funds |

If you choose VB payments:

-

You will maintain ownership and control of your pension funds after you retire. Depending on your tolerance for risk, therefore, you will have the opportunity to earn a higher retirement income than you might receive as a monthly pension. You will also have limited flexibility to vary your retirement income from year to year. However, you will face risks that do not apply to monthly pension payments.

-

You will continue to face investment risk after you retire. Starting VB payments does not change how your pension funds are invested. Your pension funds will remain invested in the same fund(s) as before you retired, unless you change your investments. If your pension funds are invested mostly or only in the Balanced Fund or Equity Fund, you will have the opportunity to earn a higher income, but you will also have a higher risk of suffering short-term losses.

Inflation risk: Whether you choose to receive a monthly pension or VB payments, you will face inflation risk in retirement. Prices generally increase each year. The investments supporting your VB payments may or may not produce adequate returns to keep up with inflation. By continuing to hold some of your pension funds in the Balanced Fund or Equity Fund, you could partially offset the impact of inflation during retirement.

Mortality risk: Once you retire and begin to spend your pension funds, you will face mortality risk. This is the risk that your funds will run out and your VB payments will stop during your lifetime. To reduce this risk, most Canadian provinces impose maximum withdrawal limits. However, your pension funds could still be impaired, or even exhausted, through investment losses. If you continue to withdraw the maximum amount, or even a specified amount, regardless of your investment returns, the entire amount of your pension funds might be spent much sooner than you think. Reducing your VB payments following a year when returns are low can help to reduce this risk.

The CSS Pension Plan offers four investment funds: A Balanced Fund, Equity Fund, Bond Fund and Money Market Fund.

Used in combination, the Bond Fund and Equity Fund can serve as an alternative to the Balanced Fund. By using them you can have the flexibility to adjust the percentage of stocks you hold over bonds, and vice versa.

As you contemplate retirement, you may feel comfortable remaining fully invested in the Balanced Fund. You should remember, however, that the Balanced Fund will experience short-term losses that will impact your retirement income. If you are planning to choose VB payments, you should re-examine your fund mix. Retirees have shorter time horizons and different needs. Older investors typically move a larger portion of their portfolio to fixed-income investments like bonds. This reduces the frequency and severity of short-term losses but does not eliminate them.

Although using the Money Market Fund can help to stabilize your retirement income, moving your entire balance into the Money Market Fund might be too conservative – even for a retiree. The expected return of the Money Market Fund can be too low to offset inflation. It can also actually be lower than the rate at which you could convert your pension funds into a regular pension. By holding a significant portion of your pension funds in the Bond Fund, for example, you would have the opportunity to earn higher average returns than the Money Market Fund.

Further, by continuing to hold some of your pension funds in the Balanced Fund or Equity Fund, you would usually tend to earn better returns than bonds during periods of rising inflation. A retiree receiving VB payments, therefore, might still want to have some pension funds in the Balanced Fund or Equity Fund for many years into retirement.

As you approach retirement, you should review with a qualified financial advisor or a CSS Retirement and Pension Advisor the proportion of pension funds held in each of the Plan’s four investment funds. If you wish to move some or all of your accumulated pension funds among the Funds, you must complete an Investment Instructions form.

If you elect to receive VB payments you will maintain ownership and control of your pension funds. You will also have some flexibility in terms of your payment amount. The downside of this control and flexibility, however, is that there is no guarantee of a lifetime retirement income. You will remain exposed to investment risk and will face mortality risk after you retire.

| Equities vs. bonds* | # Losing years** | Average loss | Worst loss | Expected return*** | Volatility |

| 100% Equities 0% Bonds |

6 | -14.4% | -28.7% | 7.9% | 16.4% |

| 80% Equities

20% Bonds

|

6 | -10.1% | -20.2% | 7.2% | 13.0% |

| 60% Equities

40% Bonds

|

6 | -6.4% | -11.8% | 6.4% | 9.8% |

| 40% Equities

60% Bonds

|

6 | -3.3% | -4.4% | 5.5% | 6.8% |

| 20% Equities

80% Bonds

|

4 | -3.0% | -7.0% | 4.5% | 4.8% |

| 0% Equities

100% Bonds

|

5 | -5.5% | -10.5% | 3.4% | 5.1% |

In most provinces, pension legislation tries to limit mortality risk – the risk of running out of funds – by setting a maximum annual withdrawal limit. But even in provinces where a maximum limit applies, there is a chance that weak investment returns could cause you to run out of money. Prudent payment choices can help to reduce the risk that you will outlive your VB payments.

Your investment returns are an important factor when setting the amount of your VB payments. You should therefore consider how your investment returns might change after retirement. Not sure where to start? Our Retirement and Pension Advisors are here to help. Please contact us.