Investment performance update

11/01/2023

Investment performance update.

As the Plan looks at year-to-date (YTD) performance, we find our Balanced and Equity Funds underperforming their benchmarks. Although disappointing, it is important to remember that we do expect our funds to underperform from time to time, and we need to be aware of the potential perils of recency bias in our decision-making (see part 5 of our behavioural finance series). What follows is an examination of some of the contributing factors to this recent underperformance along with a discussion of several aspects of the Plan’s disciplined investment strategy.

As we have discussed in the past, one of CSS’ key investment beliefs is the protection of our members’ capital. This does not mean that the Plan’s investments can never incur losses, as some level of risk is necessary to generate the returns required to provide a reasonable pension income, but it does mean we have a preference for investment styles and strategies that provide downside protection while maintaining long-term return expectations.

This belief is particularly important for those members who are near or in retirement and are sensitive to the frequency and depth of negative returns when they occur. A prime example of the benefits of this philosophy played out in 2022, an exceptional year in which both stock and bond markets incurred significant negative returns. Rising interest rates and inflation in 2022 poked a hole in significantly overvalued technology sector equity valuations and led to falling valuations for bonds. The Plan’s Balanced Fund benchmarks recorded a -9.21% return in 2022, but the Plan’s investment managers protected against some of these losses providing a -5.86% return for the year; this represents a positive 3.35% of outperformance or value-add for our members invested in the Balanced Fund.

As we find ourselves at the midpoint of 2023, market excitement around the potential of artificial intelligence (AI) has reignited market sentiment for technology companies expected to benefit from this megatrend. Perhaps unsurprisingly, the companies perceived to benefit the most from AI are the mega-cap U.S. technology companies. These have been the most popular and trendy stocks in the recent past.

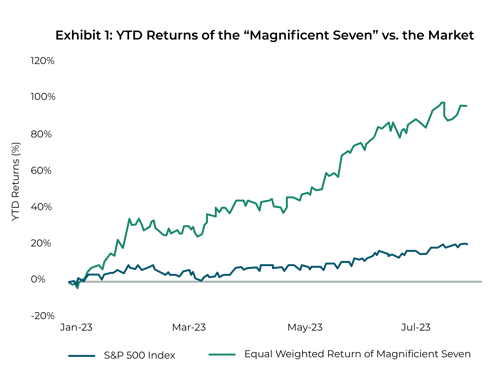

Apple, Microsoft, Nvidia, Amazon, Alphabet, Tesla and Meta, what are now called the “magnificent 7” in the financial press, account for most of the S&P 500’s year-to-date (YTD) returns.

Source: Factors and The Magnificent Seven | BlackRock

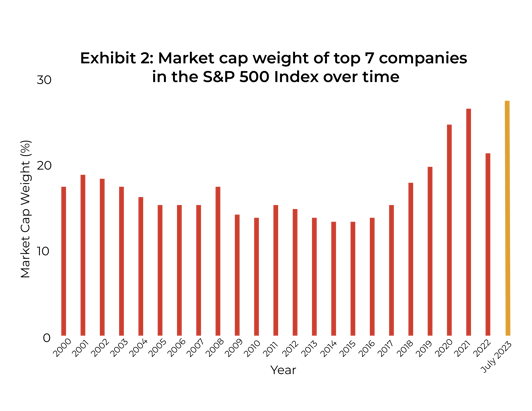

As a consequence of this recent performance, the U.S. stock market concentration is again reaching all-time highs. You have to go back more than 100 years to find a period with even more market concentration.

From a pension plan and a fiduciary perspective, these trends create a number of concerns.

Source: Morningstar Direct as of 7/31/23. Market cap weight of top 7 names calculated as of December 31 of each corresponding year (with the exception of 7/31/23). For any year where Alphabet was part of the top 7, both the A Class and C class were included in the calculation (GOOGL and GOOG).

1. First, is the impact on diversification. Diversification is another key investment belief of CSS and very much related to our protection of capital belief. Typically, broad market benchmarks like the S&P 500 are perceived to be diversified, but that is not currently the case given the concentration levels noted above. Contrary to the market, our U.S. large-cap equity manager currently looks very different, as it is more broadly diversified across industry sectors and companies. This broader diversification and lack of concentration in the mega-cap tech stocks has led to significant underperformance compared to the S&P 500. This is a leading contributor to our Equity and Balanced Fund underperformance relative to the benchmark YTD.

Members may expect that this short-term underperformance should lead to termination of a manager or a change in investment strategy, but as a prudent investor concerned for the protection of our members’ capital, we cannot ignore this high level of concentration and the risk that it can pose in periods of market stress or idiosyncratic (peculiar market) events. We know from history that market-cap weighted indexes generally experience greater drawdowns in these types of events and high levels of concentration can exacerbate this experience. Our U.S equity portfolio is positioned to protect against these types of outcomes, but at the expense of fully participating in speculative run ups in prices, as appears to be occurring in 2023.

2. Second, returns for mega-tech stocks have driven their valuations to excessive levels compared to history. Tesla’s forward valuation (next 12 months) marked at 78.8X as of June 20, while Nvidia traded at 56.8X, Amazon at 46.0X and Microsoft at 35.2X. Outsized earning expectations and optimism related to AI are contributors to these very high valuation levels. One of our investment partners recently noted:

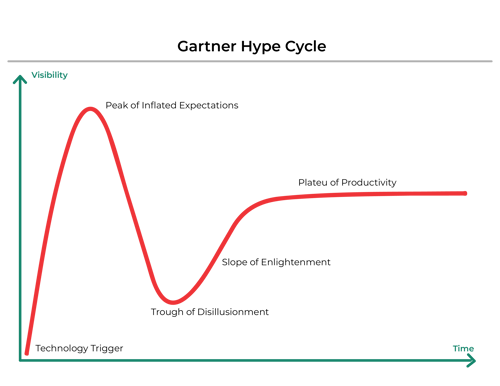

“While AI will create meaningful long-term growth opportunities both for leaders in the space and productivity gains broadly across the real economy, many of these developments remain relatively distant promises. In the meantime, AI likely lies somewhere in the initial arc of a classic technology hype cycle.”

Accordingly, these stocks are vulnerable to price declines as lofty expectations take longer to realize than originally anticipated. We saw a similar phenomenon during the tech bubble of 2000 and, to a lesser extent, the over-valuation and subsequent rapid decline of marijuana stocks when marijuana was legalized in Canada in 2014.

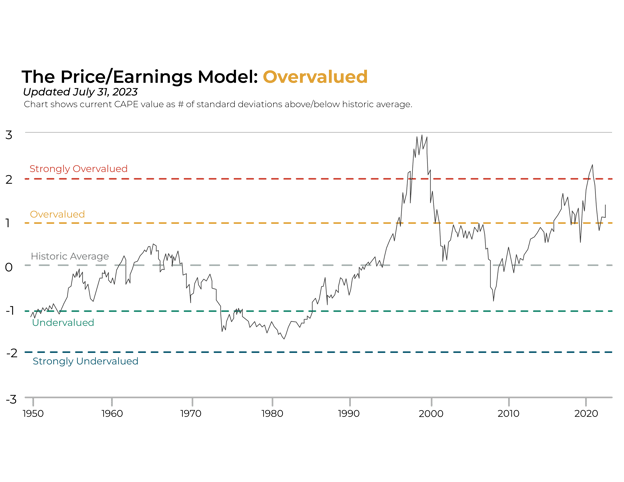

In addition to the uncertainty around AI, there remains a number of other challenges facing markets including war, inflation, rising rates, banking chaos and recession. It seems unusual that with all these heightened risks the S&P 500 has moved back into overvalued territory as measured by the Cyclically Adjusted Price to Earnings (CAPE) ratio.

In conclusion, while we share in the disappointment of short-term underperformance to benchmarks – after all, our own retirement savings are invested in the same pension plan - CSS continues to believe that being disciplined is important to achieving our long-term goals. This can be extremely challenging when not owning certain stocks in concentrated markets can really hurt short to medium-term performance.

We are aware our members can look at this performance and become impatient and anxious as they believe they are missing out. As long-term investors, we believe our strategy to invest in a diversified portfolio of equities with reasonable valuations and quality characteristics will pay off in the long run.

Article from the Fall/Winter 2023 issue of TimeWise.

.png)