Your future self will thank you. Perhaps your future self will even thank your employer!

A pension plan is a great way to build your retirement. You and your employer each contribute to CSS Pension Plan, and when you retire – you will turn your savings into retirement income.

The CSS Pension Plan is one of Canada’s largest defined contribution pension plans. As a member, you have access to low-cost, well-diversified, professionally managed investment options. Research indicates that with large-scale pooled plans, like the CSS Pension Plan, every $1 of member contribution provides an average retirement income of $4.19 compared to $1.94 from group RRSPs or small defined contribution plans. 1

Your employer believes in your financial success now and well into your retirement years, and as such, they have brought the CSS Pension Plan to you. By having the CSS Pension Plan as part of your total rewards package, your employer shows their commitment to you and your overall financial wellness.

How can you make the most of this part of your employer’s total rewards package? Consider the following tips and information.

By having the CSS Pension Plan as part of your total rewards package, your employer shows their commitment to you and your overall financial wellness.

1. Saving can improve your well-being.

Your pension plan savings can help you feel more financially secure now (and into your retirement); this reduces your financial stress. Financial stress can lead to physical and mental stress – which can take away from your ability to enjoy work and life.

Canadians say money is their top source of stress and this can lead to anxiety, depression and mental health challenges. 2

“Employers investing in retirement plans are investing in the performance of employees while they’re working for their companies. When people are financially insecure, they cannot be fully present at work [and in life].” 3

Saving into a pension plan is one way that could help you improve financial wellness. There are other ways that you can tackle this type of stress:

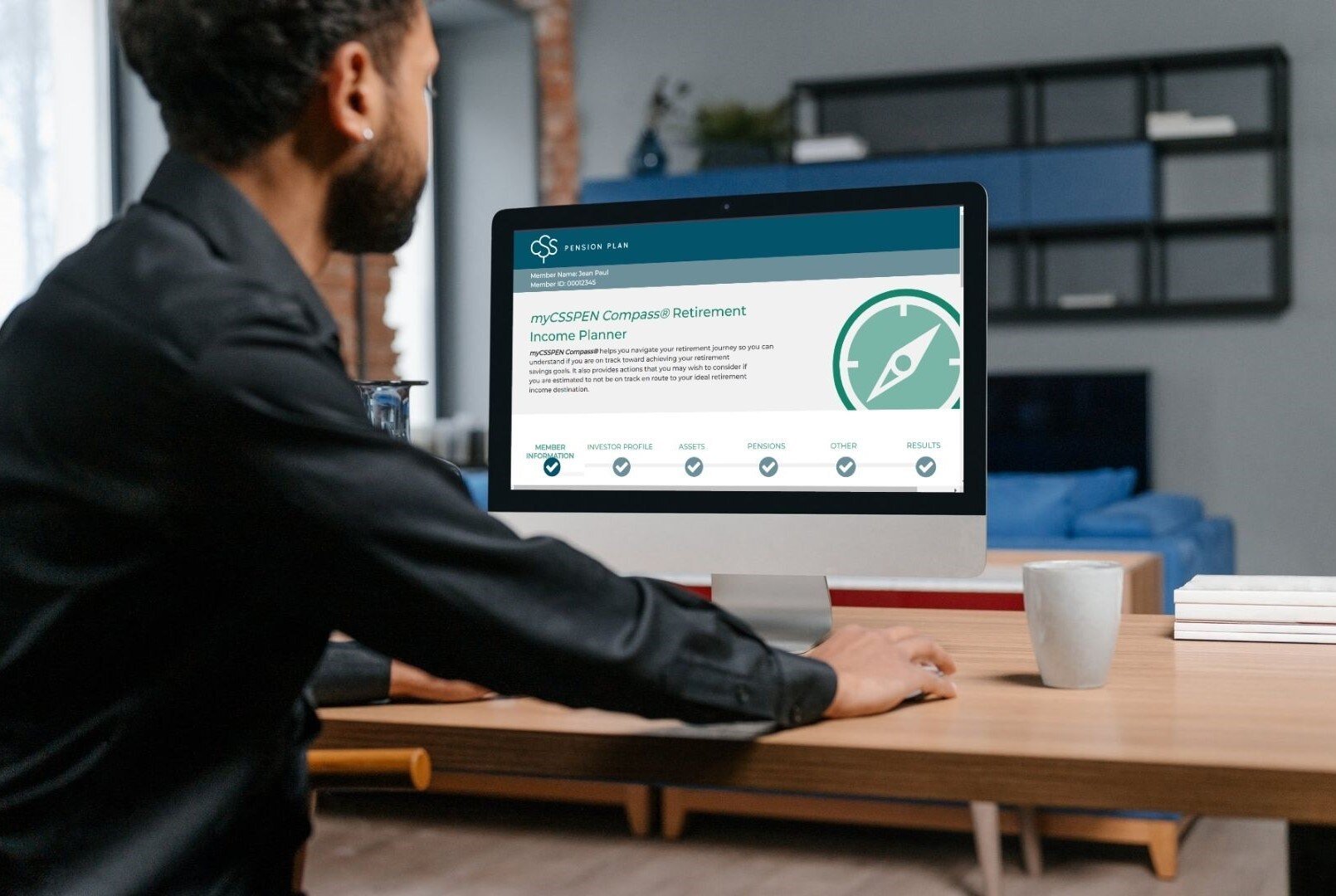

- Use the online tools that CSS provides to help you understand if you are on track for the retirement you envision

- Take the time to understand your current financial situation such as debt, savings and budgeting considerations

As you approach retirement, speak to one of CSS’ Retirement and Pension Advisors to understand how your plan works for you.

2. Just one in three Canadians belong to a pension plan

Only 38% of working Canadians are part of a registered pension plan. It is important to your employer, and to CSS, that we provide a valuable pension to you and many others in the co-operative and credit union industry.

Did you know that 66% of Canadians would rather have a lower salary and a pension (or better pension) than a higher salary with no pension (or worse pension)?4 That same research also indicated that “while older Canadians who are closer to retirement are more likely to take the pension over the salary, half of young workers under 35 still choose the pension over salary.”

Reflecting on those people who don’t have a retirement plan in place, almost 75% of those people have less than $1000 in savings. This suggests that access to a retirement savings plan (like CSS Pension Plan) is a major driver of savings behaviour for retirement (see footnote 1).

3. Present bias: A retirement savings conundrum

Would you like $100 today or would you like $120 one month from now? How about $100 one year from now versus $120 in 13 months? The decision you are faced with is the idea of “present bias”, and it can make saving now a bit tougher. We often focus on our current self and our current needs, wants and desires – and put less focus on our future self. We almost see that future self as a stranger … “why would I want to save for a stranger?”

Being aware of this bias will help you care for that future you. There are great ways that your CSS Pension Plan and your employer are helping you navigate this bias:

- Contributions made via payroll … this is a simple way to save for retirement.

- Matched contributions … rewarding you for saving now for your future self.

- Mandatory enrollment … full-time eligible employees take part in the CSS Pension Plan.

- Education and awareness … CSS provides tools and education to help you see what saving now can mean for your future.

4. Savings can reduce spending

Creating a budget that includes retirement savings may help you organize your spending patterns and build good savings habits. Building a budget that includes retirement savings is a great way to help you understand where the money is going and where you can make positive changes like paying down high-interest debt and creating short-term savings.

A budgeting tool that may help you with this regard is the Budget Planner available on the Canada.ca website.

5. Value of a good pension plan

Reaching financial security in retirement can be a challenge. The combination of government programs (e.g., CPP, OAS), personal sources (e.g., TFSAs, RRSPs) and employer-sponsored sources (e.g., CSS Pension Plan) will help you to keep up with your retirement living needs. Your CSS Pension Plan is a great tool for you to use to obtain financial security in retirement.

What makes a pension plan good? Research shows that (see footnote 1) the CSS Pension Plan hits the mark in many ways:

- Ensures that its membership is saving by making participation mandatory

- Provides significant value-for-money, includes low costs

- Keeps investment choices simple to help make your investment decision easier

- Achieves adequate long-term returns through a combination of fiduciary governance and professional investment management

- Pools longevity and investment risk

Your financial wellness matters – today and well into your future.

Thank you for making CSS Pension Plan part of your financial future.

-

Common Wealth, 2018. The value of a good pension: How to improve the efficiency of retirement savings in Canada. https://hoopp.com/home/pension-advocacy/research/most-efficient-way-to-save-for-retirement.

-

https://www.fpcanada.ca/planners/2023-financial-stress-index

-

“PwC’s 8th annual Employee Financial Wellness Survey, PwC US, 2019.” (2019). https://www.pwc.com/us/en/private-company-services/publications/assets/pwc-2019-employee-wellness-survey.pdf#page=18

-

https://hoopp.com/home/pension-advocacy/research/canadian-retirement-survey-2022

Article from the Fall/Winter 2023 issue of TimeWise.

.png)